Table of Content

I think you got good chances of getting approved. DCU Insurance helps you achieve financial well-being by protecting your most valuable personal assets – home, car, and earnings – from the ever-present, serious threat of property and liability losses. We treat you the way DCU members expect to be treated. We provide you top quality products from great insurers, fair prices, outstanding service, and member education. Typically, lenders have a “maximum LTV” threshold in place which determines how much of a loan they are willing to finance for a vehicle based on its value. As you may imagine, on-time payments will result in a higher score, while late payments and collection accounts will damage your score.

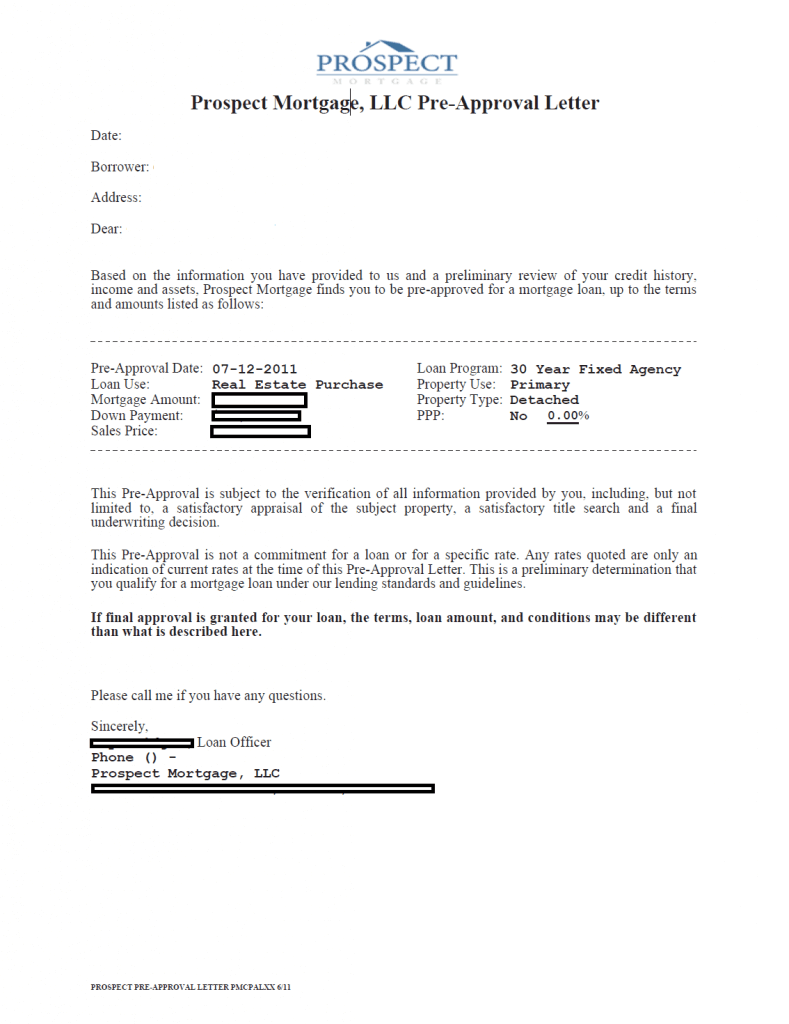

In general, you can expect to pay 2-5% of your loan balance in closing costs. Speak with your Loan Originator for more details. You may be able to roll your closing costs into your loan amount, so no amount is due at the closing table. The amount will vary depending on escrow, taxes, insurance, pre-paid interest or if you pay points to buy down your interest rate.

Pros And Cons Of Financing Through Dcu

For new or used vehicles -with the same low rates. Looking to take advantage of the equity you’ve built in your home? DCU explains how cash-out refinancing works and when it makes financial sense. Expert guidance – Whether this is your first refinance, or one of many, our experienced Loan Originators are here to answer your questions and make it an easy process.

She has previously written for Crypto News Australia and was employed as a content writer at Monzi Personal Loans. Based in Brisbane, her goal is to make the financial world easily comprehensible, particularly for the younger generations. The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. Some programs may give you instant online approval.

I Got The Digital Federal Credit Union Car Loan Now What

While the actual algorithms are highly complicated, the factors that go into determining your score aren’t. Your FICO score is somewhere between three hundred and eight fifty. A higher score indicates that you are considered a less risky borrower than someone with a lower score. The first and most important component is your payment history. Thirty-five percent of your score is based on how you’ve paid your bills. One of the benefits of financing with DCU is that we will service your loan as long as you have it.

All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. We believe everyone should be able to make financial decisions with confidence. Forbes Advisor adheres to strict editorial integrity standards.

Savings Account

Any business or other legal entity located in one of these areas is also automatically eligible to join. Become familiar with the types of offers, and the terms and conditions that can make or break your purchase before you head to the dealership. There are many factors you should consider when refinancing a mortgage. Use our mortgage refinance calculators to estimate the cost and potential savings. Great rates with no annual fees, cash advance fees, or balance transfer fees.

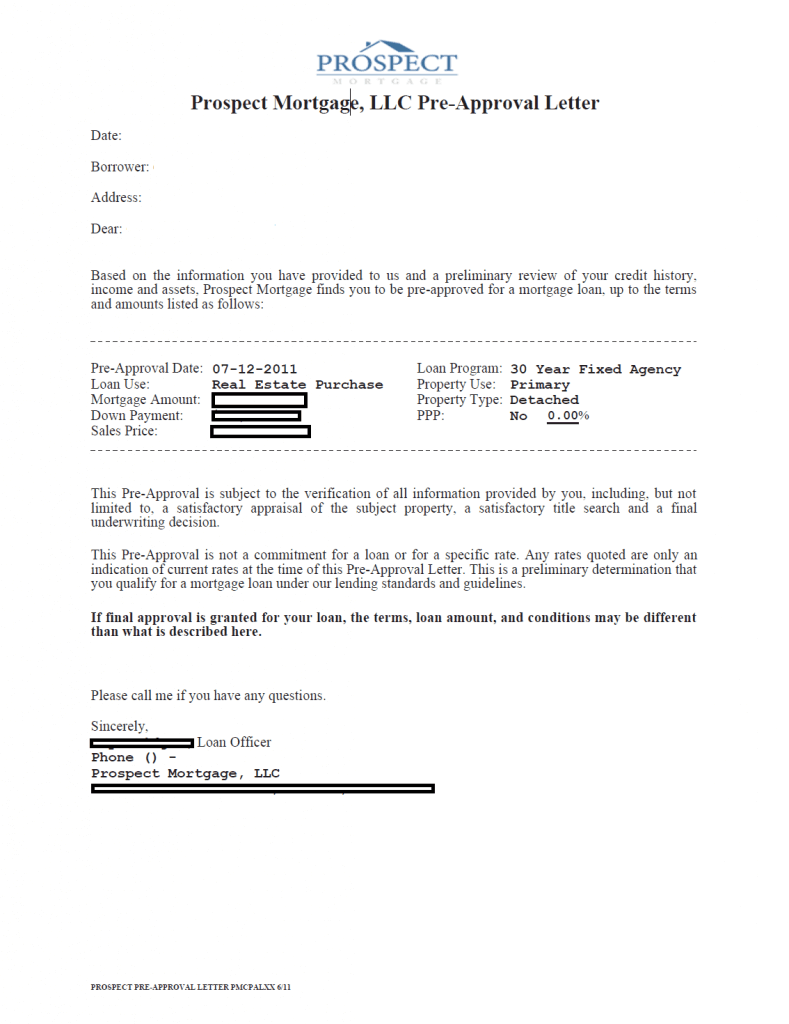

If your loan application is denied post pre-approval it may be best to withhold from immediately placing another application. Each time you apply for pre-approval, or a loan, this will be marked on your credit report as an enquiry. Frequent enquiries may be considered a red flag by lenders. A pre-approval that includes a bank assessment is likely to provide you with a more concrete estimation of your borrowing power.

Free Checking

A home loan pre-approval serves as a non-committal ‘go-ahead’ from your lender and can provide a degree of clarity and confidence to your property search. Obtaining home loan pre-approval before you find your dream home can offer you a realistic budget, and help you avoid the heartbreak of being unable to qualify for a property that’s caught your eye. When I opened for a checking account I got preapproval for a car loan. I decided to apply for their credit card and instantly approved!

I am going to ask them if i can use the personal loan sp offer switch to credit increase for visa lets see ... Rates are determined by your personal credit history, loan term, account relationship, and payment method. Members may be eligible for a 0.50% discount by maintaining electronic payments on the loan and Plus or Relationship benefits on your DCU checking account. Rates and terms on loans for other types of vehicles, including mobility vehicles, will differ.

Many borrowers complain that DCUs online system was difficult to navigate. And others stated communication with customer service representatives was difficult and unclear. If you choose DCU as your auto loan provider but dont live in New Hampshire or Massachusetts, be prepared to navigate most details of your auto loan online. Shop for vehicles from multiple dealerships in the Treasure and Magic Valleys and apply for an auto loan without having to leave your browser or the comfort of your home. Applicable rate varies depending on member’s credit qualification. Credit limit based on credit qualifications and loan-to-value ratio (up to 97% of fair market value of Michigan primary residence less other liens).

When you do find a home that you love in your price range, you have the peace of mind to proceed to auction or make an offer. Pre-approval, sometimes referred to as conditional approval or approval in principle, is an indication from your lender of how much you may be able to borrow. You do not have to have found the house you intend to buy. Rather, pre-approval can help you to narrow your search and eventually place an offer with confidence. Relieve the financial stress and worry related to making loan payments. We needed to get preapproved for a car loan, the process took about an hour and was completely seamless.

Whether your dream car is new or just new-to-you, DCU's auto loans make it easy to hit the road by offering low rates and flexible terms. A cash out refinance allows you to tap into the equity in your home. After you close, you’ll receive a check for the difference between your current mortgage payoff + closing costs and your loan amount. A rate and term refinance changes your interest rate and/or the term of your mortgage, typically loan amount remains the same unless you wish to roll closing costs in. Loan to value is the ratio that compares the amount of a loan against the value of the vehicle.

Materials and resources to help you manage your finances and your personal loan. Choose from our easy to use calculators to help you manage your personal loan. DCU is a not-for-profit, member-owned credit union that puts you first. And unlike banks, we don’t answer to the needs of stockholders. This loan appeals to buyers who plan to move or refinance in the short term. Our Mortgage Learning Center will help you gain a better understanding of the mortgage process – from prequalification to keys in hand.

I accepted the offer this morning and got a one line response that I clicked away from before fully comprehending. I'm trying to position myself to have a bit more low interest CL available for when my kitchen stuff comes off 0% in the spring. I'll likely be able to get it back onto 0%, but I want a bit more breathing room of under 10%/no BT Fees in case it's necessary. From what I have read if dcu has an offer for u it's a soft pull. Let us help you save money on your next car or the one you already drive today.

No comments:

Post a Comment